A QUICK STEP-BY-STEP GUIDE

How To Register an

LLC

A simple, step-by-step guide to forming your LLC correctly and staying compliant from day one.

A QUICK STEP-BY-STEP GUIDE

A simple, step-by-step guide to forming your LLC correctly and staying compliant from day one.

You've developed a groundbreaking new business plan, found the perfect commercial space, and chosen a unique business name. Now, all that's left to do is register your business. The structure you choose determines your level of limited liability, tax benefits and growth potential, and needs to be properly organized under the law of the state of operation.

One business structure you can choose is a limited liability company (LLC). The formation of an LLC involves specific legal steps and filings such as submitting the articles of organization to the correct state agency.

During the formation of an LLC you can choose between a domestic LLC (which is organized and registered in the state you plan to do business in) and a Foreign LLC (which is formed under the laws of another state). LLCs, as well as other entities, operate under the chosen management structure providing flexibility in how the business is run. While the process of LLC registration is fairy straightforward, we've put together a guide to make launching your business even easier.

When you are creating a new business, choosing the correct entity structure is one of the most important choices you will make. The business type you choose will determine the level of personal liability protection, how your company is managed, and the way ownership is structured.

A limited liability company (LLC) is such a popular choice for new business owners because it offers liability protection to its owners and members, which means your personal assets are generally protected from any legal claims and business debts. LLCs can be formed by one or more individuals, providing flexibility in both ownership and management. This business type is ideal for those looking for a balance between liability protection and operational simplicity.

Choosing the right business entity, whether it’s an LLC, sole proprietorship, general partnership, or limited partnership, will shape your company’s future, affecting everything from liability and management to ownership and profit distribution. Carefully consider your options to ensure your new business is set up for success.

An LLC is a business structure that allows for at least one member with no maximum number of members. A domestic limited liability company is one formed under the laws of the state where it operates. It’s a popular entity choice for small to medium businesses as it offers maximum tax flexibility and limited liability.

LLCs may comprise individuals, partnerships, corporations and even other LLCs. Some states allow the formation of professional limited liability companies (PLLCs) for licensed professionals such as dentists, veterinarians, architects, or accountants, and professional services like law, medicine, or accounting may require a specific type of LLC. LLCs can be managed by their members or by appointed managers.

Registering your business as an LLC will slightly vary depending on the state of formation, but there are four typical steps to consider before. Filling your articles of organization with the Secretary of State's office is an extremely important first step in LLC formation. You will typically need to obtain a certificate of organization from the state, and there will be fees that come along with this filing process. The Secretary of State's office, along with relevant state departments like the Department of Revenue, oversee the registration and ongoing compliance of entities like LLCs.

If your desired business name is already in use, you may need to register an assumed name for your LLC. For foreign LLCs, which are those formed in another state but wishing to operate locally, it is necessary to register with the state, obtain a certificate of authority, and meet all procedural requirements to legally transact business. These steps ensure your LLC is properly recognized and authorized to operate within the state.

According the United States Small Business Administration, there are currently over 36 million small businesses in America. Coming up with an original business name helps differentiate your business from the many other enterprises operating in your specific state. Along with helping to stand out, having a unique business name is required for LLCs and must comply with the follow guidelines:

If the business name is already being used or has been reserved, you might have to register a DBA or assumed name, to be able to legally operate in that state. For foreign LLCs, which are formed in a different state but is registering to conduct business in a new state, they may be required to register a DBA if their original name in their state of formation is unavailable in the new state they are trying to form their foreign LLC in.

Services like Firstep Business Solutions will check for name availability and compliance in your state to ease the process of creating your LLC.

Every state will require your business to have a registered agent appointed to be able to accept any service of process on behalf of your business. "Service of process" refers to any documentation sent to the business from a government agency, typically this will be a notice of pending litigation against your business.

There are requirements of a qualified registered agent, including:

The filing of your articles of organization is a required step to legally register your company as an LLC. This involves submitting the articles of organization to the appropriate state agency. Once this gets approved, the state will issue your business a certificate of organization which officially recognizes your LLC.

There are certain requirements for this document, and this must define certain aspects of the entity being created, such as:

Filing articles of organization typically requires payment of state filing fees.

Although the state does not require you to have an operating agreement, many banks and vendors you will work with do. The operating agreement is a document that defines the relationship between the members and the business itself. It states specifically which individuals have what power to act on behalf of the business and how the business will operate, including:

Completing the previous four steps will enable you to register your LLC successfully. You’ll then need to ensure ongoing compliance and tax status by applying for an employer identification number (EIN) and filing annual reports. Maintaining the legal existence of your LLC requires timely filing of these annual reports.

Annual reports become part of the public record and are accessible to the public. Late filings may result in penalties and interest charges. State agencies and official websites offer resources to help you stay compliant with ongoing requirements.

Aside from submitting an annual tax return, LLCs have a few other compliance requirements to attend to ensure their business doors stay open. Other compliance regulations include:

As all states have unique compliance regulations, it's best to consult with your registered agent to ensure a favorable status. They'll help you confirm all the details across your paperwork for increased operation security.

From choosing a unique LLC name to creating a comprehensive operating agreement, there are many important steps to registering an LLC. Partnering with a qualified formation assistance service helps to minimize the complexity during this process, allowing you to form your LLC online with ease.

Firstep Business Solutions helps entrepreneurs like you breeze through the LLC registration paperwork so you can begin changing the world with your products and services. Learn more about how our business structure services help you launch and grow an LLC, or get started with forming your LLC today!

INCLUDES INDUSTRY-SPECIFIC AUTOMATIONS

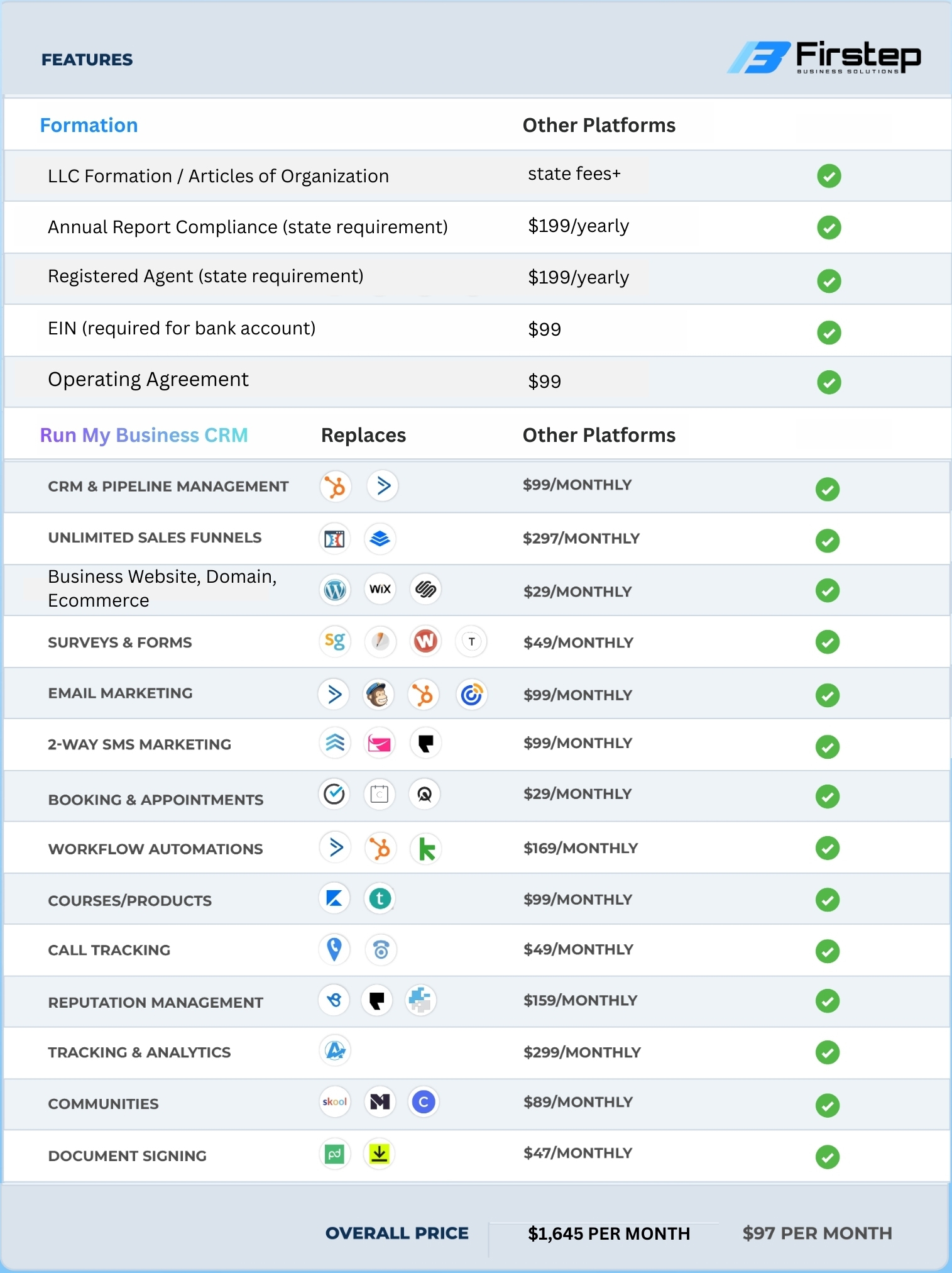

LLC Formation / Articles of Organization

LLC Formation / Articles of Organization

Annual Report Compliance (state requirement)

Annual Report Compliance (state requirement)

Registered Agent (state requirement)

Registered Agent (state requirement)

EIN (required for bank account)

EIN (required for bank account)

Operating Agreement

Operating Agreement

Business Website + hosting, ecommerce store

Business Website + hosting, ecommerce store

Run My Business CRM (replaces 37 apps!)

Run My Business CRM (replaces 37 apps!)

Additional usage and third party charges may apply.

Pick from done-for-you website templates built for your industry.

Customize in minutes and launch instantly, or let AI build your site.

Support every way they choose to pay. Send professional invoices with built-in payment links, sell online, or take payment on your phone.

Text, email, website chat, and social DMs - all in one unified inbox. No more bouncing from app to app.

Reply to customers instantly from your dashboard - or let AI reply for you.

Stay active without lifting a finger. Create, schedule, and post weeks of social content in minutes with AI.

Stand out against competitors. Automatically ask happy customers for reviews that post directly to your google business profile.

With automated marketing funnels, your clients get timely reminders, personalized offers, and thank-you messages that bring them back again and again.

Forget the Paperwork. We’ll do it.

Forget the Paperwork. We’ll do it.

Compliance Handled Automatically — Forever.

Compliance Handled Automatically — Forever.

One Platform to Run Your Entire Business.

One Platform to Run Your Entire Business.